http://www.businessinsider.com/government-spending-and-taxes-2012-12#

"Yesterday, I pointed out how, in a stubborn attempt to avoid raising taxes on the richest 2% of Americans, the Republicans in Congress have essentially agreed to raise taxes on everyone.

The Republicans have done this by refusing to accept President Obama's attempt at a compromise, which preserves low tax rates for 98% of the country while raising taxes modestly on the top 2%.

Well, you can't assign blame to the formerly pragmatic and responsible Republican party without getting some flak.

So I received some notes explaining that the Republicans were absolutely right to reject Obama's plan because "our problem is not a tax problem—it's a spending problem."

And you know what, Democrats? The writers of those notes were partially correct:

We DO have a spending problem.

If we are ever to get our budget deficit under control, we need to trim long-term spending growth.

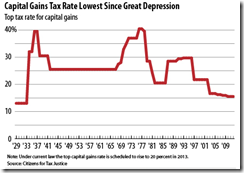

But blaming the whole deficit problem on "spending" ignores the other half of the problem: Taxes.

Our federal tax revenue right now is historically low.”