The purpose of this blog is to serve as a quick reference to political and economic data presented primarily in graphical format, with tables and other charts where appropriate. Use the search box to quickly locate the data you are seeking. Go Dems!

Saturday, August 11, 2012

Romney Chooses The Flimflam Man

Friday, August 10, 2012

Bill Moyers Essay: Everyone Should Be Entitled to Medicare

“Bill shares his thoughts on the 47th anniversary of Medicare -- the apex of Lyndon Johnson's ambitious vision for America. Bill was a key Johnson aide as they developed Medicare and pressed Congress to pass it. How to save Medicare today? The answer, says Bill, is obvious: make it available to every American.”

“On the other side, actor Ronald Reagan, still in private life, had signed on as the American Medical Association's hired spokesman in their campaign against Medicare. Doctors' wives organized thousands of small meetings in homes around the country, where guests listened to a phonograph record of Reagan deploring the evils of "socialized medicine":

"Behind it will come other Federal programs that will invade every area of freedom as we have known it in this country [...] until one day, as Norman Thomas said [...] you and I are going to spend our sunset years telling our children and our children's children what it once was like in America when men were free."

But now, it was Lyndon Johnson's turn. Tragically thrust into the White House by Kennedy's assassination, LBJ, the son of Franklin Roosevelt's New Deal and Harry Truman's Fair Deal, vowed to finish what they had started. He pushed us relentlessly to get it done. Here he is talking to his Vice President, Hubert Humphrey, in early March of 1965:

"They are bogged down. The House had nothing this week, all ---damn week. Now that's where you and Moyers and Larry O'Brien have got to find something for them. And the Senate had nothing [...] so we just wasted three weeks [...] Now we are here in the first week in March, and we have just got to get these things passed [...] I want that program carried. And I'll put every Cabinet officer behind you. I'll put every banker behind you. I'll put every organization we got behind you [...] I'll put the labor unions behind you."

About all he had left was the White House kitchen sink, and pretty soon he threw that behind us, too.

Later that March he called me to talk about a retroactive increase in Social Security payments that we were supporting. I had argued for it as a stimulus to the economy. LBJ said okay, but reminded me that social security and Medicare were about a lot more than economics:

"My inclination would be [...] that it ought to be retroactive as far back as you can get it [...] because none of them ever get enough. That they are entitled to it. That that's an obligation of ours. It's just like your mother writing you and saying she wants $20, and I'd always sent mine a $100 when she did. I never did it because I thought it was going to be good for the economy of Austin. I always did it because I thought she was entitled to it. And I think that's a much better reason and a much better cause and I think it can be defended on a hell of a lot better basis [...] We do know that it affects the economy [...] But that's not the basis to go to the Hill, or the justification. We've just got to say that by God you can't treat grandma this way. She's entitled to it and we promised it to her."

LBJ kept that promise. He pushed and drove and cajoled and traded, until Congress finally said yes. And so it was that 47 years ago, we traveled to Independence, Missouri, the hometown of Harry Truman, and there with the former president at his side, LBJ signed Medicare into law. Turning to Truman, whom he called "the real daddy of Medicare, " Johnson signed him up as its first beneficiary. Harry Truman was 81.

All this was high drama, touched with history, sentimentality, politics, and compromise. A whole lot of compromise. The bill wasn't all LBJ wanted. It was, in fact, deeply flawed. There were too few cost controls, as some principled conservatives warned, who were then rudely ignored. Co-pays and deductibles remain a problem. And we didn't anticipate the impact of new technology, or the impact of a burgeoning population.

In fact, even as he signed the bill we still weren't sure what all was in it. As LBJ himself once told me, never watch hogs slaughtered before breakfast and never, never, never show young children how legislation gets enacted.

But Lyndon Johnson had warned: "We will face a new challenge and that will be what to do within our economy to adjust ourselves to a life span and a work span for the average man or woman of 100 years."

That longevity, and the cost, are what we must now reckon with. As the historian Robert Dallek has written, Medicare and Medicaid, the similar program for the very poor, "...did not solve the problem of care at reasonable cost for all Americans", but "the benefits to the elderly and the indigent...are indisputable."

And there's no going back, current efforts notwithstanding. A new study in the journal Health Affairs finds that Medicare beneficiaries age 65 and older are more satisfied with their health insurance, have better access to care, and are less likely to have problems paying medical bills than working-age adults who get insurance through employers or purchase coverage on their own.”

Wizards of I.D.

Papa John's CEO Says 'Obamacare' Will Up Pizza Price

“The CEO and founder of Papa John's pizza wants investors to know that when the president's health care law takes effect, the price of pizza is going up with it.

According to "Papa" John Schnatter, the cost of providing health insurance for all of his pizza chain's uninsured, full-time employees comes out to about 14 cents on a large pizza. That's less than adding an extra topping and a third the price of an extra pepperoncini. If you want that piping hot pie delivered, the $2 delivery fee will cost you 14 times as much as that health insurance price hike.”

Friday, July 20, 2012

Half Of American Households Hold 1 Percent Of Wealth

From the site:

"The share of the nation's wealth held by the less affluent half of American households dropped precipitously after the financial crisis, to 1.1 percent, according to new calculations by Congress's nonpartisan research service."

Romney’s and Obama’s tax plans, in one (new and improved) chart

Great chart from Ezra Klein's blog:

"It’s also worth noting that these numbers only tell half the story: Romney has promised to offset the cost of most of his tax plan through spending cuts and tax reforms, and so any analysis of who pays is incomplete without those policies. But that information is impossible to graph, as Romney hasn’t released it yet. All we can say is that since Romney has promised to increase spending on defense and honor Medicare and Social Security’s scheduled benefits for the next decade, it’s hard to see how he makes good on that promise without cutting deep into programs for the poor and tax preferences that benefit the middle class, and if that’s right, then the poor and middle class are paying much more than you can tell from the graph above."

Sunday, July 15, 2012

The Class-Warfare Election - NYTimes.com

Paul Krugman links to an excellent chart from Ezra Klein. From the site:

"So like it or not, we have an election in which one candidate is proposing a redistribution from the top — which is currently paying lower taxes than it has in 80 years — downward, mainly to lower-income workers, while the other is proposing a large redistribution from the poor and the middle class to the top."

Sunday, July 8, 2012

Molly Ivins on Inflation, the Fed, and Full Employment

Molly Ivins September 24 by Molly Ivins on Creators.com - A Syndicate Of Talent

And words of tribute from a Paul Krugman blog post from 2007 -- still rings true today:

http://www.nytimes.com/2007/02/02/opinion/02krugman.html?_r=2&hp

Monday, July 2, 2012

Obamacare is the biggest tax increase in history … if you ignore history

"Maybe you’ve heard that Obamacare is the biggest tax increase in history. Not so. Not even close. Kevin Drum posted the evidence in a table. I turned it into a chart."

http://theincidentaleconomist.com/wordpress/obamacare-is-the-biggest-tax-increase-in-history-if-you-ignore-history/

Saturday, June 23, 2012

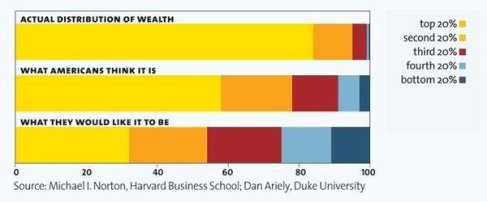

Wealth Inequality Graph

"In last night's introduction to Rachel's interview with Chris Hayes about his new book, she showed a graph depicting the wealth distribution people prefer, the distribution they think exists and the actual distribution of wealth in America. Folks on the Twitter clamored for the link, and our intern Sally tells me there are a lot of requests for it in the Rachel@msnbc.com mailbox as well, so here it is."

http://maddowblog.msnbc.msn.com/_news/2012/06/21/12345961-that-wealth-inequality-chart-rachel-showed-last-night?lite

Tuesday, June 12, 2012

More Firemen, More Policemen, More Teachers

http://krugman.blogs.nytimes.com/2012/06/12/more-firemen-more-policemen-more-teachers/?nl=opinion&emc=edit_ty_20120612

First, Mitt Romney ridiculed Obama for saying that we need more public employment:

He says we need more firemen, more policemen, more teachers. Did he not get the message in Wisconsin?

Afterwards, some commentators wondered, couldn’t he have chosen different professions to ridicule?

And the answer is no. When we talk about public workers, that’s pretty much who we’re talking about:

Monday, June 11, 2012

As unions decline, inequality rises

"To a remarkable extent, inequality, which fell during the New Deal but has risen dramatically since the late 1970s, corresponds to the rise and fall of unionization in the United States."

Sunday, June 3, 2012

How the "Job Creators" REALLY Spend Their Money

http://www.commondreams.org/view/2012/05/29-1

Unfortunately for Eric Ferhnstrom, a senior campaign advisor to the Romney campaign, Paul Krugman (who's been on a tear lately) was on "This Week" Sunday morning to dismantle all of his vapid talking points.

http://crooksandliars.com/blue-texan/week-paul-krugman-destroys-romney-surro

"Unfortunately for Eric Ferhnstrom, a senior campaign advisor to the Romney campaign, Paul Krugman (who's been on a tear lately) was on "This Week" Sunday morning to dismantle all of his vapid talking points."

Bush on Jobs -- The Worst Track Record on Record

http://blogs.wsj.com/economics/2009/01/09/bush-on-jobs-the-worst-track-record-on-record/

Saturday, June 2, 2012

Comparison of European and US Gas Prices

http://grist.org/energy-policy/the-only-solution-to-high-gas-prices-with-charts/

Sunday, May 27, 2012

GOP War on Voting

http://www.newscorpse.com/ncWP/?p=5335

Krugman, Laffer on Real Time with Bill Maher

[NOTE: I rechecked the link and it's been removed as of 05 31 12. Sorry! Might be elsewhere on YouTube]

http://www.youtube.com/watch?v=TWW49wXzs84

How National Belt-Tightening Goes Awry

Robert Shiller writing in the New York Times:

http://www.nytimes.com/2012/05/20/business/economy/how-national-belt-tightening-goes-awry-economic-view.html

"Consider our current thinking about taxes and government spending. We seem caught up in a “family belt-tightening” metaphor, in which the nation is a family that has outspent its income and is trying to get back in control. The family must cut profligate spending, save and pay down debts. It’s a powerful thought, of course, because we know that mismanagement of household finances can lead to a family’s ruin.But perhaps the most important lesson conveyed by the great economist John Maynard Keynes is that this metaphor, when applied to the national economy, is fundamentally misleading: what is smart for the family is not smart for society as a whole. This idea, sometimes known as the paradox of thrift, is that when we all tighten our belts at once, the economy is so weakened that we end up failing to save more, and instead are all worse off. When that happens, some collective action — government stimulus — is needed."

How Chief Justice John Roberts orchestrated the Citizens United decision.

http://www.newyorker.com/reporting/2012/05/21/120521fa_fact_toobin?currentPage=all

Barack Obama has lowest spending record of any recent president

http://www.politifact.com/truth-o-meter/statements/2012/may/23/facebook-posts/viral-facebook-post-says-barack-obama-has-lowest-s/

Table from the site:

What Republicans Really think about Bain Capital

Here are the top 10 comments about Bain from Romney’s Republican rivals:

http://thinkprogress.org/politics/2012/05/22/488113/10-things-mitt-romneys-republican-primary-opponents-said-about-bain/

From the site:

1. “The idea that you’ve got private equity companies that come in and take companies apart so they can make profits and have people lose their jobs, that’s not what the Republican Party’s about.” — Rick Perry [New York Times, 1/12/12]

2. “The Bain model is to go in at a very low price, borrow an immense amount of money, pay Bain an immense amount of money and leave. I’ll let you decide if that’s really good capitalism. I think that’s exploitation.” — Newt Gingrich [New York Times, 1/17/12]

3. “Instead of trying to work with them to try to find a way to keep the jobs and to get them back on their feet, it’s all about how much money can we make, how quick can we make it, and then get out of town and find the next carcass to feed upon” — Rick Perry [National Journal, 1/10/12]

4. “We find it pretty hard to justify rich people figuring out clever legal ways to loot a company, leaving behind 1,700 families without a job.” — Newt Gingrich [Globe and Mail, 1/9/12]

5. “Now, I have no doubt Mitt Romney was worried about pink slips — whether he was going to have enough of them to hand out because his company, Bain Capital, of all the jobs that they killed” — Rick Perry [New York Times, 1/9/12]

6) “He claims he created 100,000 jobs. The Washington Post, two days ago, reported in their fact check column that he gets three Pinocchios. Now, a Pinocchio is what you get from The Post if you’re not telling the truth.” — Newt Gingrich [1/13/12, NBC News]

7. “There is something inherently wrong when getting rich off failure and sticking it to someone else is how you do your business, and I happen to think that’s indefensible” — Rick Perry [National Journal, 1/10/12]

8. “If Governor Romney would like to give back all the money he’s earned from bankrupting companies and laying off employees over his years, then I would be glad to then listen to him” — Newt Gingrich [Mediaite, 12/14/11]

9. “If you’re a victim of Bain Capital’s downsizing, it’s the ultimate insult for Mitt Romney to come to South Carolina and tell you he feels your pain, because he caused it.” — Rick Perry [New York Times, 1/8/12]

10. “They’re vultures that sitting out there on the tree limb waiting for the company to get sick and then they swoop in, they eat the carcass. They leave with that and they leave the skeleton” — Rick Perry [National Journal, 1/10/12]

David Stockman Talks about Romney Job Creation

http://www.youtube.com/watch?v=Fu4-6o44d6M

"I don't think that Mitt Romney can legitimately say that he learned anything about how to create jobs in the LBO business. The LBO business is about how to strip cash out of old, long-in-the-tooth companies and how to make short-term profits…All the jobs that he talks about came from Staples. That was a very early venture stage deal. That, you know they got out of long before it got to its current size."

Saturday, January 21, 2012

Total Effective Federal Tax Rate By Income -- 2007

"Our income tax system is designed to be “progressive.” That is, we generally agree that people with higher incomes should pay a greater percentage of their income in federal income taxes, because they can afford to pay more. But because capital gains are concentrated at the highest levels of income and taxed at favorable rates, many of the most affluent taxpayers pay a lower effective tax rate than those beneath them on the income scale."

http://www.americanprogress.org/issues/2011/02/te022311.html

Saturday, January 7, 2012

What If Obama Loses?

http://www.washingtonmonthly.com/magazine/january_february_2012/features/what_if_he_loses034501.php

It’s a common complaint—we’ve certainly made it over the years—that too much political campaign coverage focuses on the horse race. The packed debate schedule in the current GOP nomination battle has put a bit more focus than usual on the substance of what the candidates are saying, which is good. But even so, most of this coverage has wound up being about whether a given policy position might help or hurt a candidate’s chances of winning. What’s most important has been left largely unexamined: if one of these candidates actually becomes president and advances his or her policies, what would be the consequences for the nation?

Friday, January 6, 2012

U.S. debt was a better investment than gold this year

Inside the Beltway, our country’s debt load was politically toxic in 2011, but in the global marketplace, it was even better than gold. The euro-zone crisis sent investors fleeing for the relative safety of U.S. Treasurys. Now the U.S. bond market is set to have its best year since 2008, with a 13.7 percent return — significantly outperforming the stock market in 2011. What’s more, the Wall Street Journal points out, “the biggest star was the 30-year Treasury bond, with a 35% return, far outpacing even gold, another favorite safe-haven asset.”

Monday, January 2, 2012

Nobody Understands Debt

http://www.nytimes.com/2012/01/02/opinion/krugman-nobody-understands-debt.html

In 2011, as in 2010, America was in a technical recovery but continued to suffer from disastrously high unemployment. And through most of 2011, as in 2010, almost all the conversation in Washington was about something else: the allegedly urgent issue of reducing the budget deficit.

Another Excellent Inequality Study

The Congressional Research Service (CRS) isn’t as well known in these parts as the CBO, but their reports are widely considered equally reliable and nonpartisan.

So I took notice of their newly released study on income inequality.

Thursday, December 29, 2011

More Year End Graphs from Jared Bernstein's Blog

http://jaredbernsteinblog.com/the-best-of-cbpp-graphics/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+JaredBernstein+%28Jared+Bernstein%29

My CBPP colleagues contributed many important graphics to the debates of 2011 in lots of different areas, including fiscal, poverty, inequality, health care, and more. But which ones to highlight in this end-of-year look back at the best of 2011? I generally used a market test: these are the ones that were most widely circulated.

Wednesday, December 28, 2011

The Big Lie Goes Viral

http://www.ritholtz.com/blog/2011/12/nytimes-takes-on-the-big-lie/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+TheBigPicture+%28The+Big+Picture%29

http://www.bloomberg.com/news/2011-12-23/lies-damn-lies-and-the-big-whoppers-of-2011-commentary-by-jonathan-alter.html

http://www.nytimes.com/2011/12/24/opinion/nocera-the-big-lie.html?_r=1

http://www.cjr.org/the_audit/bloomberg_takes_on_the_big_lie.php

Tuesday, December 27, 2011

Best 2011 Economic Charts

http://www.epi.org/publication/11-telling-charts-about-2011-economy/

http://www.npr.org/blogs/money/2011/12/22/144139101/the-year-in-4-charts?sc=nl&cc=pmb-20111223

http://www.washingtonpost.com/business/economy/economists-explain-2011-in-charts/2011/12/21/gIQAT3lg9O_gallery.html#photo=1

The Mathematical Economics of Compound Rates of Interest: A Four-Thousand Year Overview

http://michael-hudson.com/2004/01/the-mathematical-economics-of-compound-rates-of-interest-a-four-thousand-year-overview-part-i/

Economic writers in earlier times were more ready than their modern counterparts to confront the problem of debts growing so large as to be unpayable. In The Wealth of Nations (V, iii), Adam Smith observed that “Bankruptcy is always the end of great accumulation of debt. The liberation of the public revenue, if it has ever been brought about at all, has always been brought about by a bankruptcy; sometimes by an avowed one, but always by a real one, though frequently by a pretended payment.”

Thursday, December 22, 2011

THE U.S. FEDERAL BUDGET: INFOGRAPHIC

http://www.cbo.gov/doc.cfm?index=12577

The United States is facing significant and fundamental budgetary challenges. The federal government's budget deficit for fiscal year 2011 was $1.3 trillion; at 8.7% of gross domestic product (GDP), that deficit was the third-largest shortfall in the past 40 years. (GDP is the sum of all income earned in the domestic production of goods and services. In 2011, it totaled $15.0 trillion.)

Today In Dishonest Fox News Charts

http://mediamatters.org/blog/201112120005

Correlation or Causation?

http://www.businessweek.com/magazine/correlation-or-causation-12012011-gfx.html#

Need to prove something you already believe? Statistics are easy: All you need are two graphs and a leading question. Correlation may not imply causation, but it sure can help us insinuate it.

Sunday, December 18, 2011

Some Good Links on Alternative Banking Systems

http://publicbanking.wordpress.com/

Also, Ellen Brown's Time for a New Theory of Money:

http://www.yesmagazine.org/new-economy/time-for-a-new-theory-of-money

Michael Hudson on the Mathematical Economics of Compound Rates of Interest:

http://michael-hudson.com/2004/01/the-mathematical-economics-of-compound-rates-of-interest-a-four-thousand-year-overview-part-i/

Michael Hudson writing in the excellent New Economic Perspectives blog:

http://neweconomicperspectives.blogspot.com/2011/11/some-modest-proposals-for-reforming-us.html

John Nichols on Banking for the People:

http://www.thenation.com/article/banking-people

Tomas Edison on Public Financing of Private Projects

http://www.publicbankinginstitute.org/thomas-edison-article

“Now, as to paper money, so called every on knows that paper money is the money of civilized people. The higher you go in civilization the less actual money you see. It is all bills and checks. What are bills and checks? Mere promises and orders. What are they based on? Principally on two sources—human energy and the productive earth. Humanity and the soil they are the only real basis of money.

Saturday, December 17, 2011

The GOP's 'Uncertainty' Talking Point, Debunked

http://www.huffingtonpost.com/2011/11/13/gop-uncertain-economy-debunked_n_1088448.html

WASHINGTON -- With the economy in a slump for nearly four years, corporate executives and conservative politicians have repeatedly invoked "uncertainty" as a major barrier to American job-creation. The "uncertainty" jab is a go-to talking point for any congressional Republican looking to tag President Barack Obama as a tax-raising, regulation-obsessed foe of American businesses.

But according to banking data compiled by economic research firm Moebs Services, the uncertainty plaguing the American economy has nothing to do with government regulations or taxes on millionaires. It's an uncertainty driven squarely by consumers and small-businesses who are worried about their short-term financial prospects. And it's been going on since well before Obama took up residence in the White House.

The Koch Brothers, ALEC and the Savage Assault on Democracy

http://www.thenation.com/blog/165077/koch-brothers-alec-and-savage-assault-democracy

Billionaire brothers Charles and David Koch finally got their way in 2011. After their decades of funding the American Legislative Exchange Council, the collaboration between multinational corporations and conservative state legislators, the project began finally to yield the intended result.

Thursday, December 15, 2011

The Book of Jobs

http://www.vanityfair.com/politics/2012/01/stiglitz-depression-201201?wpisrc=nl_wonk

Forget monetary policy. Re-examining the cause of the Great Depression—the revolution in agriculture that threw millions out of work—the author argues that the U.S. is now facing and must manage a similar shift in the “real” economy, from industry to service, or risk a tragic replay of 80 years ago.

Saturday, December 10, 2011

Words That Don't Work

http://www.huffingtonpost.com/george-lakoff/occupy-rhetoric_b_1133114.html?ref=daily-brief?utm_source=DailyBrief&utm_campaign=120711&utm_medium=email&utm_content=BlogEntry&utm_term=Daily%20Brief

Progressives had some fun last week with Frank Luntz, who told the Republican Governors' Association that he was scared to death of the Occupy movement and recommended language to combat what the movement had achieved. But the progressive critics mostly just laughed, said his language wouldn't work, and assumed that if Luntz was scared, everything was hunky-dory. Just keep on saying the words Luntz doesn't like: capitalism, tax the rich, etc.

It's a trap.

When Luntz says he is "scared to death," he means that the Republicans who hire him are scared to death and he can profit from that fear by offering them new language. Luntz is clever. Yes, Republicans are scared. But there needs to be a serious discussion of both Luntz's remarks and the progressive non-response.

The Financial Crisis Was Entirely Foreseeable

http://www.ritholtz.com/blog/2011/12/the-financial-crisis-was-entirely-foreseeable/

We’ve Known for Thousands of Years

We’ve known for literally thousands of years that debts need to be periodically written down, or the entire economy will collapse. And see this.

We’ve known for 1,900 years that that rampant inequality destroys societies.

We’ve known for thousands of years that debasing currencies leads to economic collapse.

We’ve known for hundreds of years that the failure to punish financial fraud destroys economies.

We’ve known for hundreds of years that monopolies and the political influence which accompanies too much power in too few hands is dangerous for free markets.

We’ve known for hundreds of years that trust is vital for a healthy economy.

We’ve known since the 1930s Great Depression that separating depository banking from speculative investment banking is key to economic stability. See this, this, this and this.

We’ve known since 1988 that quantitative easing doesn’t work to rescue an ailing economy.

We’ve known since 1993 that derivatives such as credit default swaps – if not reined in – could take down the economy. And see this.

We’ve known since 1998 that crony capitalism destroys even the strongest economies, and that economies that are capitalist in name only need major reforms to create accountability and competitive markets.

We’ve known since 2007 or earlier that lax oversight of hedge funds could blow up the economy.

And we knew before the 2008 financial crash and subsequent bailouts that:

The easy credit policy of the Fed and other central banks, the failure to regulate the shadow banking system, and “the use of gimmicks and palliatives” by central banks hurt the economy

Anything other than (1) letting asset prices fall to their true market value, (2) increasing savings rates, and (3) forcing companies to write off bad debts “will only make things worse”

Bailouts of big banks harm the economy

The Fed and other central banks were simply transferring risk from private banks to governments, which could lead to a sovereign debt crisis

Given the insane levels of debt, rampant inequality, currency debasement, failure to punish financial fraud, growth of the too big to fails, repeal of Glass-Steagall, refusal to rein in derivatives, crony capitalism and other shenanigans … the financial crisis was entirely foreseeable.

O goes YOYO

http://jaredbernsteinblog.com/o-goes-yoyo/

Here’s how I saw this back in the mid-2000s, in the heart of the GW Bush years, when the YOYOs were riding high (from my book, All Together Now: Common Sense for a Fair Economy):

… One central goal of the YOYO movement is to continue and even accelerate the trend toward shifting economic risks from the government and the nation’s corporations onto individuals and their families. You can see this intention beneath the surface of almost every recent conservative initiative: Social Security privatization, personal accounts for health care (the so-called Health Savings Accounts), attacks on labor market regulations, and the perpetual crusade to slash the government’s revenue through regressive tax cuts — a strategy explicitly tagged as “starving the beast” — and block the government from playing a useful role in our economic lives. …

While this fast-moving reassignment of economic risk would be bad news in any period, it’s particularly harmful today. As the new century unfolds, we face prodigious economic challenges, many of which have helped to generate both greater inequalities and a higher degree of economic insecurity in our lives. But the dominant vision has failed to develop a hopeful, positive narrative about how these challenges can be met in a way as to uplift the majority.

Instead, messages such as “It’s your money” (the mantra of the first George W. Bush campaign in 2000), and frames such as “the ownership society,” stress an ever shrinking role for government and much more individual risk taking. Yet global competition, rising health costs, longer life spans with weaker pensions, less secure employment, and unprecedented inequalities of opportunity and wealth are calling for a much broader, more inclusive approach to helping all of us meet these challenges, one that taps government as well as market solutions.

The Real Way to Help Small Business

http://www.nytimes.com/2011/12/09/opinion/the-real-way-to-help-small-business.html?_r=1&hp

Research shows that a mere 1 percent of small business owners make more than $1 million per year. Only about 5.4 million of the nation’s 20 million small businesses pay any wages at all. The Republican claim about wealthy small business job creators, it turns out, is based on a convenient and overly broad definition of “small” that includes partnerships and S-corporations, like hedge funds, accounting firms, law practices and other often big businesses.

So when they claim to be protecting small business from high-end taxes, Republicans are really talking about protecting big companies whose owners fall into the one-half of 1 percent of taxpayers who are millionaires or better. A surtax would certainly not hurt them.

Boehner’s Big Stretch on Small Business

House Speaker John Boehner claimed that “small-business people” make up more than half of those who would be hit by a tax increase on “millionaires.” Not really. Only 13 percent of those making over $1 million get even as much as one-fourth of that income from small business, according to government tax experts.

GOP Objects To 'Millionaires Surtax'; Millionaires We Found? Not So Much

We wanted to talk to business owners who would be affected. So, NPR requested help from numerous Republican congressional offices, including House and Senate leadership. They were unable to produce a single millionaire job creator for us to interview.

So we went to the business groups that have been lobbying against the surtax. Again, three days after putting in a request, none of them was able to find someone for us to talk to. A group called the Tax Relief Coalition said the problem was finding someone willing to talk about their personal taxes on national radio.

Friday, December 9, 2011

Cosma Shalizi - Why Economics Needs Data Mining

Cosma Shalizi urges economists to stop doing what they are doing: Fitting large complex models to a small set of highly correlated time series data. Once you add enough variables, parameters, bells and whistles, your model can fit past data very well, and yet fail miserably in the future. Shalizi tells us how to separate the wheat from the chaff, how to compensate for overfitting and prevent models from memorizing noise. He introduces techniques from data mining and machine learning to economics -- this is new economic thinking.

ALEC Deems Kids Eating Rat Poison An ‘Acceptable Risk’

http://thinkprogress.org/health/2011/12/06/383108/alec-deems-kids-eating-rat-poison-an-acceptable-risk/

As ThinkProgress has been reporting for some time, the corporate front group American Legislative Exchange Council (ALEC) has been colluding with the billionaire Koch brothers to privatize government and eliminate environmental regulations that interfere with profits.

GOP legislators in many states have given ALEC free reign to write anti-health care reform and anti-environment legislation. Now, ALEC is fighting to kill Environmental Protection Agency (EPA) rules limiting the sale of rat poisons that pose a serious health threat to children and the ecosystem.

How to Create 19 Million Jobs and Push Unemployment Below 5 Percent

http://www.peri.umass.edu/

Robert Pollin, James Heintz, Heidi Garrett-Peltier and Jeannette Wicks-Lim show that since 2009, U.S. commercial banks and large nonfinancial corporations have been carrying huge cash hoards and other liquid assets, totaling $1.4 trillion. Small businesses, by contrast, have been locked out of credit markets. The authors examine the impact on job creation of mobilizing these excess liquid assets into productive investments, finding that U.S. employment could expand by about 19 million jobs by the end of 2014, with unemployment falling below 5 percent. The paper discusses policies to transform these hoards into job-generating investments, both for the national economy and, specifically, the Los Angeles and Seattle regions.

Wednesday, December 7, 2011

Activists show up to 'retake' Congress

http://usnews.msnbc.msn.com/_news/2011/12/06/9255645-activists-show-up-to-retake-congress

By plane, train and bus, thousands of activists are converging on Washington, D.C. this week to “Take Back Our Capitol.” Though the pilgrimage borrows the some of the language of the Occupy protests, and includes a contingent of those activists, the crowd hails largely from nonprofits and political organizations.

"We came to tell members of Congress that they should represent the 99 percent not just corporations and the 1 percent," said Colleen Bugarske, 59, a volunteer from West Los Angeles with MoveOn.org, a national nonprofit political advocacy group.

Bill Moyers Essay: Plutocracy and Democracy Don't Mix

http://vimeo.com/32805018

BILL MOYERS: You've no doubt figured out my bias by now. I've hardly kept it a secret. In this regard, I take my cue from the late Edward R. Murrow, the Moses of broadcast news.

Ed Murrow told his generation of journalists bias is okay as long as you don't try to hide it. So here, one more time, is mine: plutocracy and democracy don't mix. Plutocracy, the rule of the rich, political power controlled by the wealthy.

Monday, December 5, 2011

How to Pay for What We Need

http://theamericanscholar.org/how-to-pay-for-what-we-need/

The conventions of our money supply are so arcane that explanation is daunting. Journalist William Greider once observed that the American process of money creation is “a powerful mystery to most citizens.” Indeed, he wrote, it is a mystery to most elected leaders, who tend to believe that the process is best “left to the experts, a forbidden area where politicians [are] not supposed to intrude.” In Secrets of the Temple: How the Federal Reserve Runs the Country, Greider quoted the head of the Federal Reserve Bank of New York, who went so far as to assert that “no President really understands these things.”

If that’s true, it’s nothing less than a major civic tragedy, one we should not allow to continue. Why should we tolerate a state of affairs in which people use economic jargon instead of giving an intelligible answer to the following conceptual questions: Where does modern money come from? And what does it consist of?

Newt Gingrich Wants To Kill CBO

http://capitalgainsandgames.com/blog/stan-collender/2416/newt-gingrich-wants-kill-cbo?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+CapitalGainsAndGames+%28Capital+Gains+and+Games+-+Wall+Street%2C+Washington%2C+and+Everything+in+Between%29

Former Speaker and current GOP presidential candidate Newt Gingrich might well have said that he wants to kill his personal physician because he didn’t like being told his blood pressure was too high.

But that’s the equivalent of what Gingrich did say during a recent debate, when he made it clear that the Congressional Budget Office has to be eliminated if health care reform is going to be repealed.

According to Gingrich, the CBO should be done away with because its analysis shows that, as enacted, health care reform reduces the federal budget deficit. This means that repealing it — as many in the GOP base to which Gingrich is appealing wants to do — will increase the deficit and, therefore, require spending cuts or revenue increases to offset the impact. That, of course, will make the repeal effort much harder and far less likely.

Sunday, December 4, 2011

Newt’s War on Poor Children

http://www.nytimes.com/2011/12/03/opinion/blow-newts-war-on-poor-children.html?partner=rss&emc=rss

I enjoyed this from one of the commenters:

Gingrich's hypocrisy on the issue of work is unbelievable, given the fact that when he himself was a student, according to an interview , his stepmother gave to Gail Sheehy, quoted in a PBS Frontline story, " The Inner Quest of Newt Gingrich", during his college years, Newt called his father and stepfather to ask for financial help. His stepmother recalls that his exact words were

"I do not want to go to work. I want all my time for my studies.."

Not only that, but according to Dolores Adamson, Gingrich's district administrator from 1978 to 1983, his wife Jackie "put him all the way through school. All the way through the P.h.D...He didn't work."

The conservative movement embodies this quote from John Kenneth Galbraith:

"The modern conservative is engaged in one of man's oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness."

Saturday, December 3, 2011

New CBO Report: Up to 2.4 Million People Owe Their Jobs to the Recovery Act

http://www.offthechartsblog.org/new-cbo-report-up-to-2-4-million-people-owe-their-jobs-to-the-recovery-act/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+OffTheChartsBlog+%28Off+the+Charts+Blog+|+Center+on+Budget+and+Policy+Priorities%29

A new Congressional Budget Office analysis finds that the 2009 Recovery Act (ARRA) is continuing to save jobs and protect the economy from what would have been a much deeper recession. As we describe in an updated analysis, in the third quarter of 2011 the Recovery Act:

--increased the number of people employed by between 0.4 million and 2.4 million,

--increased real GDP by between 0.3 percent and 1.9 percent (see chart below),

We have to do better on inequality

http://www.ft.com/cms/s/2/66102f44-11db-11e1-a114-00144feabdc0.html#axzz1eHudQHZ8

The principal problem facing the US and Europe for the next few years is an output shortfall caused by a lack of demand. Nothing would increase the incomes of all citizens – poor, middle-class and rich – as much as an increase in demand and associated increases in incomes, living standards and confidence in institutions and the future.

The A-List

The A-list

Our exclusive online section featuring agenda-setting commentary from leading contributors on global finance, economics and politics

It would, however, be a serious mistake to suppose that our problems are only cyclical or amenable to macroeconomic solution. Just as the evolution from an agricultural to an industrial economy has far-reaching implications for almost all institutions, so too does the evolution from an industrial to a knowledge economy. Trends that pre-date the Great Recession will be with us long after any recovery.

The most important of these is the strong shift in the market reward for a small minority of citizens relative to the rewards available to most citizens. According to a recent Congressional Budget Office study, the incomes of the top 1 per cent of the US population, after adjusting for inflation, rose by 275 per cent from 1979 to 2007. At the same time, the income for the middle class grew by only 40 per cent. Even this dismal figure overstates the case of typical Americans, as the number unable to find work or who have abandoned the search has risen. In 1965, only 1 in 20 men between 25 and 54 was not working; by the end of this decade it will probably be 1 in 6, even if the full cyclical recovery is achieved.

The Left-Behinds

http://www.nationaljournal.com/magazine/america-s-left-behinds-the-long-term-unemployed-20111117

How three decades of flawed economic thinking have helped to create record numbers of long-term unemployed and undermine America’s middle class.

Senator McCain’s Economist Warns: If you Criticize Banksters They will Prolong Recessions

http://www.ritholtz.com/blog/2011/11/senator-mccain%E2%80%99s-economist-warns-if-you-criticize-banksters-they-will-prolong-recessions/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+TheBigPicture+%28The+Big+Picture%29

Steven J. Davis, Senator McCain’s chief economics advisor during his presidential campaign, has written a political hit piece on the man that defeated his candidate. His co-authors were Scott R. Baker and Nicholas Bloom. For the sake of brevity I will refer to the authors as “the authors” or “Davis.” They published the piece in

Bloomberg The article purports to be a straight scientific piece, but it is a partisan screed relying on faux statistics created by Davis to support his views. Davis’ statistical methodology is not simply unscientific, it is embarrassingly bad.

Why the Rich Are Getting Richer

http://www.foreignaffairs.com/articles/67046/robert-c-lieberman/why-the-rich-are-getting-richer?page=show

The economic crisis of the 1970s, which heralded the end of a generation of U.S. economic dominance, helped their cause by laying bare the limitations of the New Deal order. The country's economic and social policy regime -- which relied heavily on the private provision of important social protections, such as pensions and health insurance -- may have been adequate for a globally dominant industrial economy that generated 30 years of widely shared growth and stable employment for millions of industrial workers. But in the 1970s, it began to prove thoroughly inadequate for an era of globalization, deindustrialization, and economic dislocation, as displaced workers found themselves unable to rely on the government for economic protection. This, in Hacker and Pierson's parlance, was policy drift on a massive scale.

Ascendant conservatives seized on this state of affairs to argue that the whole New Deal edifice of social protection, financial regulation, progressive taxation, and civil rights should be dismantled rather than reinforced. Beginning with the Carter administration, the expanding business lobby successfully defeated proposal after reform proposal and aggressively promoted an opening round of tax cuts and deregulation -- mere down payments on the frenzy to come.

Roger Ailes’ Secret Nixon-Era Blueprint for Fox News

Republican media strategist Roger Ailes launched Fox News Channel in 1996, ostensibly as a "fair and balanced" counterpoint to what he regarded as the liberal establishment media. But according to a remarkable document buried deep within the Richard Nixon Presidential Library, the intellectual forerunner for Fox News was a nakedly partisan 1970 plot by Ailes and other Nixon aides to circumvent the "prejudices of network news" and deliver "pro-administration" stories to heartland television viewers.

Examining the big lie: How the facts of the economic crisis stack up

Rather than attend a college-level seminar on the complex philosophy of causation, we’ll keep it simple. To assess how blameworthy any factor is regarding the cause of a subsequent event, consider whether that element was 1) proximate 2) statistically valid 3) necessary and sufficient.

Consider the causes cited by those who’ve taken up the big lie. Take for example New York Mayor Michael Bloomberg’s statement that it was Congress that forced banks to make ill-advised loans to people who could not afford them and defaulted in large numbers. He and others claim that caused the crisis. Others have suggested these were to blame: the home mortgage interest deduction, the Community Reinvestment Act of 1977, the 1994 Housing and Urban Development memo, Fannie Mae and Freddie Mac, Rep. Barney Frank (D-Mass.) and homeownership targets set by both the Clinton and Bush administrations.

When an economy booms or busts, money gets misspent, assets rise in prices, fortunes are made. Out of all that comes a set of easy-to-discern facts.

How Republicans are being taught to talk about Occupy Wall Street

http://news.yahoo.com/blogs/ticket/republicans-being-taught-talk-occupy-wall-street-133707949.html;_ylt=Al8yBVMwvNZh49E17Ewt1NibCMZ_;_ylu=X3oDMTFna3UycmU1BG1pdANCbG9nIEluZGV4IGJ5IEJsb2cEcG9zAzMwBHNlYwNNZWRpYUJsb2dJbmRleA--;_ylg=X3oDMTFvcGs0cnBnBGludGwDdXMEbGFuZwNlbi11cwRwc3RhaWQDBHBzdGNhdANibG9nBHB0A3NlY3Rpb25zBHRlc3QD;_ylv=3

The Republican Governors Association met this week in Florida to give GOP state executives a chance to rejuvenate, strategize and team-build. But during a plenary session on Wednesday, one question kept coming up: How can Republicans do a better job of talking about Occupy Wall Street?

"I'm so scared of this anti-Wall Street effort. I'm frightened to death," said Frank Luntz, a Republican strategist and one of the nation's foremost experts on crafting the perfect political message. "They're having an impact on what the American people think of capitalism."

Luntz offered tips on how Republicans could discuss the grievances of the Occupiers, and help the governors better handle all these new questions from constituents about "income inequality" and "paying your fair share."

Friday, December 2, 2011

Economics and Inequality

http://www.bostonreview.net/BR36.6/kenneth_arrow_occupy_movement_future.php

The notion of a well-running market is applicable to manufactured goods; different items are produced to be alike and can be evaluated by consumers. But the products of the finance and health industries are individualized and complex. The consumer cannot seriously evaluate them—a situation that economists call “asymmetric information.”

This casts light on the claim that the problem is one of personal ethics, of greed. After all, the search for improvement in technology, and consequently in the general standards of living, is motivated by greed. When the market system works properly, greed is tempered by competition. Hence, most of the gains from innovation and good service cannot be retained by the providers.

But in situations of asymmetric information, the forces of competition are weakened. The individual patient or financial client does not have access to all the relevant information. Indeed, when the information is sufficiently complex, it may be impossible to provide adequate information.

In these circumstances, greed becomes more relevant. There arises an obligation to present the relevant information as fully as possible, an obligation that has been violated in the financial industry. In the medical field, this challenge has to a considerable extent been met historically by standards of proper practice. These may involve revelation of all information, or at least the requirement that differences in information not be exploited.

It is clear that the financial industry is well behind the medical in this respect. A proper sense of responsibility has to be enforced by legislation, as it was in the 1930s. There has been some erosion in the law, for example under the Clinton administration, and in enforcement. The Dodd-Frank law is a step in the right direction, but the influence of the financial industry watered it down and created unnecessary complications.

It is not superfluous to argue that steepening the income tax progression, removing a number of blatant loopholes, such as the special treatment of capital gains, and reducing the exemption level for estates would add considerably to post-tax equality.

Raise Taxes on Rich to Reward True Job Creators: Nick Hanauer

http://www.bloomberg.com/news/2011-12-01/raise-taxes-on-the-rich-to-reward-job-creators-commentary-by-nick-hanauer.html

It is a tenet of American economic beliefs, and an article of faith for Republicans that is seldom contested by Democrats: If taxes are raised on the rich, job creation will stop.

Trouble is, sometimes the things that we know to be true are dead wrong. For the larger part of human history, for example, people were sure that the sun circles the Earth and that we are at the center of the universe. It doesn’t, and we aren’t. The conventional wisdom that the rich and businesses are our nation’s “job creators” is every bit as false.

Saturday, November 26, 2011

Climate Scientist Calls Hacked 'Climategate' Emails 'Truly Pathetic'

"A truly pathetic episode," Mann added. "Agents doing the dirty bidding of the fossil fuel industry know they can't contest the fundamental science of human-caused climate change. So they have instead turned to smear, innuendo, criminal hacking of websites, and leaking out-of-context snippets of personal emails in their effort to try to confuse the public about the science and thereby forestall any action to combat this critical threat."

http://www.livescience.com/17151-climategate-emails-michael-mann.html

End Herbert Hoover-style ‘trickle-down economics’ to pay off nation’s debt

Trickle-down economics has not worked since Herbert Hoover tried it. It is a myth that adding money to the wealthy through tax cuts stimulates jobs and grows the economy. Under Democratic presidents since 1930 who have emphasized people programs and resisted tax breaks for the richest, annual growth in GDP has averaged 5.4 percent, according to Commerce Department and Office of Management and Budget statistics.

http://www.miamiherald.com/2011/07/07/2304248/end-herbert-hoover-style-trickle.html

Richard Trumka, American

The American worker has been getting thrashed for thirty years. Jobs leaving the country, wages flat, his boss getting rich. One coal miner from Pennsylvania knows exactly what to do about it.

http://www.esquire.com/features/americans-2011/richard-trumka-1211

When Did the GOP Lose Touch With Reality?

I’ve been a Republican all my adult life. I have worked on the editorial page of The Wall Street Journal, at Forbes magazine, at the Manhattan and American Enterprise Institutes, as a speechwriter in the George W. Bush administration. I believe in free markets, low taxes, reasonable regulation, and limited government. I voted for John McCain in 2008, and I have strongly criticized the major policy decisions of the Obama administration. But as I contemplate my party and my movement in 2011, I see things I simply cannot support.

http://nymag.com/print/?/news/politics/conservatives-david-frum-2011-11/

The GOP’s dual trigger nightmare in one graph

To get a sense of how progressive, here’s a graph comparing the spending cuts and tax increases in all of the major deficit-reduction packages proposed thus far. (Note: I’m measuring revenues against the tax code as it it is right now, and I’m not including savings on interest payments.)

http://www.washingtonpost.com/blogs/ezra-klein/post/the-gops-dual-trigger-nightmare-in-one-graph/2011/11/25/gIQAQSAYvN_blog.html?wprss=ezra-klein

Monday, November 21, 2011

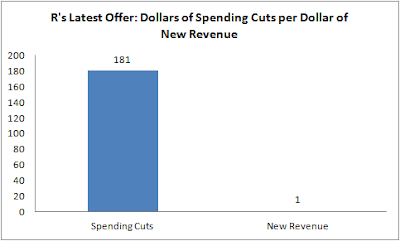

Republicans’ Latest Supercommittee Offer: $181 in Spending Cuts for Each $1 in Revenue Increases

http://www.offthechartsblog.org/republicans-latest-supercommittee-offer-181-in-spending-cuts-for-each-1-in-revenue-increases/

Sunday, November 20, 2011

Saturday, November 19, 2011

Why doing nothing yields $7.1 trillion in deficit cuts

http://www.washingtonpost.com/blogs/post-partisan/post/why-doing-nothing-yields-71-trillion-in-deficit-cuts/2011/11/16/gIQAsOdwRN_blog.html?wpisrc=nl_wonk

In my column today, I note that because certain things will happen automatically if Congress does nothing, inaction would lead to $7.1 trillion in deficit reduction over the next decade. For that reason, I argue, failure by the supercommittee to reach a deal would not necessarily be a bad thing for those who want a balanced approach to deficit reduction.

The Rising Age Gap in Economic Well-Being

http://www.pewsocialtrends.org/2011/11/07/the-rising-age-gap-in-economic-well-being/?src=prc-newsletter

Households headed by older adults have made dramatic gains relative to those headed by younger adults in their economic well-being over the past quarter of a century, according to a new Pew Research Center analysis of a wide array of government data.

Funny Video from Stephen Colbert

http://www.colbertnation.com/the-colbert-report-videos/402493/november-16-2011/elderly-occupier-pepper-sprayed?xrs=eml_col

How Alan Greenspan Helped Wreck the Economy

http://www.rollingstone.com/politics/blogs/national-affairs/how-alan-greenspan-helped-wreck-the-economy-20110616

Ayn Rand Part II -- On Capitol Hill, Rand's 'Atlas' Can't Be Shrugged Off

At the time, Rand's novels were almost universally panned. Her ideas were called "the height of immorality." Her followers, the objectivists, were seen as a radical sideshow in politics and economics.

http://www.npr.org/2011/11/14/142245517/on-capitol-hill-rands-atlas-cant-be-shrugged-off?ft=3&f=100876926&sc=nl&cc=bn-20111117

Back in that 1959 interview, Wallace asked Rand why — if her ideas were so right — Americans, in their democracy, hadn't voted to protect the all-important producer class.

Her answer? Because the people hadn't been given that choice.

"Both parties today are for socialism, in effect — for controls. And there is no party, there are no voices, to offer an actual pro-capitalist, laissez-faire, economic freedom and individualism," she said. "That is what this country needs today."

If Rand were alive today, she might be pleased to see that, more and more, Americans do have that choice. And her ideas are alive and well-represented in the U.S. Capitol.

What caused the financial crisis? The Big Lie goes viral.

http://www.washingtonpost.com/business/what-caused-the-financial-crisis-the-big-lie-goes-viral/2011/10/31/gIQAXlSOqM_story.html?sub=AR

A Big Lie is so colossal that no one would believe that someone could have the impudence to distort the truth so infamously. There are many examples: Claims that Earth is not warming, or that evolution is not the best thesis we have for how humans developed. Those opposed to stimulus spending have gone so far as to claim that the infrastructure of the United States is just fine, Grade A (not D, as the we discussed last month), and needs little repair.

Wall Street has its own version: Its Big Lie is that banks and investment houses are merely victims of the crash. You see, the entire boom and bust was caused by misguided government policies. It was not irresponsible lending or derivative or excess leverage or misguided compensation packages, but rather long-standing housing policies that were at fault.

Indeed, the arguments these folks make fail to withstand even casual scrutiny. But that has not stopped people who should know better from repeating them.

Architect of Romney's healthcare law says it's 'the same' as Obama's

Jonathan Gruber, a key intellectual architect of President Obama's overhaul of the American health care system, is a little frustrated.http://www.capitalnewyork.com/article/culture/2011/11/4156059/architect-obamas-health-care-plan-fears-political-decision-supreme-c

"I'm frustrated that the future of the American health care system rests in the hands of one or two of these unelected people who might make the decision based on political grounds," Gruber, an M.I.T. professor, told me in a phone interview on Monday, a few hours after the Supreme Court granted a writ of certiorari to hear challenges to the Affordable Care Act. "It's very disturbing."

Lawrence O'Donnell Shreds Racist Ron Paul Re. Civil Rights Act

http://www.youtube.com/watch?v=Nlw-tDGAJ7E&feature=uploademail

The Truth About GOP Hero Ayn Rand

A good reminder of the type of ideology from the right that is so misguided...Mike Wallace's interview with Ayn Rand in 1959 is still relevant today.

Paul Ryan’s solution to inequality helps the rich, does nothing for poor

Yesterday Paul Ryan released a very serious looking report entitled: “A deeper look at inequality.” Ryan’s effort — a rebuttal to that recent CBO report on growing inequality that got so much attention — was applauded by conservatives as an important contribution to the debate.http://www.washingtonpost.com/blogs/plum-line/post/paul-ryans-solution-to-inequality-helps-the-rich-does-nothing-for-poor/2011/11/18/gIQAbt1OYN_blog.html

Wednesday, November 16, 2011

How the GOP Became the Party of the Rich

http://www.rollingstone.com/politics/news/how-the-gop-became-the-party-of-the-rich-20111109

Tuesday, November 15, 2011

The End of Loser Liberalism

http://www.cepr.net/index.php/publications/books/the-end-of-loser-liberalism

Sunday, November 6, 2011

The Second Gilded Age: Has America Become an Oligarchy?

http://www.spiegel.de/international/spiegel/0,1518,793896,00.html

Through the 1970s, income for Americans across all social classes rose nearly in lockstep, by an annual average of roughly 3 percent. Starting in the 1980s, however, this trend underwent a fundamental transformation. Granted, the economy continued to grow -- but almost exclusively to the benefit of the country's top earners. The major economic expansion under President Ronald Reagan benefited only a few, and the problem only grew worse under George W. Bush.

Can Anyone Really Create Jobs?

http://www.nytimes.com/2011/11/06/magazine/job-creation-campaign-promises.html?_r=1&wpisrc=nl_wonk

Can Anyone Really Create Jobs?

The fact is that creating them in a far-too-sluggish economy is practically impossible in our current capitalist democracy. No corporate leader is rewarded for hiring people who aren’t absolutely required. Most companies hire only when its workforce can no longer keep up with the demand for its products.

Friday, November 4, 2011

Super Dupes

http://prospect.org/article/super-dupes

"With the Congressional Super Committee required to produce a bipartisan budget-cutting plan by November 23, the best possible outcome would be for the committee to collapse of its own weight.

With no deal, automatic cuts would kick in beginning in 2013. Those budget cuts would be excessive, but that question could—and will—be reopened after the election. And in the meantime, $4 trillion in Bush tax cuts will expire, solving most of the deficit problem.

If Democrats win, it’s all up for grabs. If Republicans win, the cuts will be even deeper.

The 2012 election will be a referendum on whether we want growth or austerity, and whether we want tax fairness."